What is the Reverse Charge Mechanism Under GST? – All You Need to Know

Reverse Charge Mechanism Under GST

The reverse charge mechanism is a system in which the recipient is liable to pay a tax to the government. This is a concept that has been carried forward from the previous tax regime.

Under service tax, a reverse charge was applicable in case of specific information services. Similar to VAT, in almost every state, a registered person had to pay tax to the government if purchases were made from unregistered dealers.

This was also appropriate in the case of imports, where the merchant had to pay import duty to the government. The reverse charge mechanism in GST has also been prepared along the same lines.

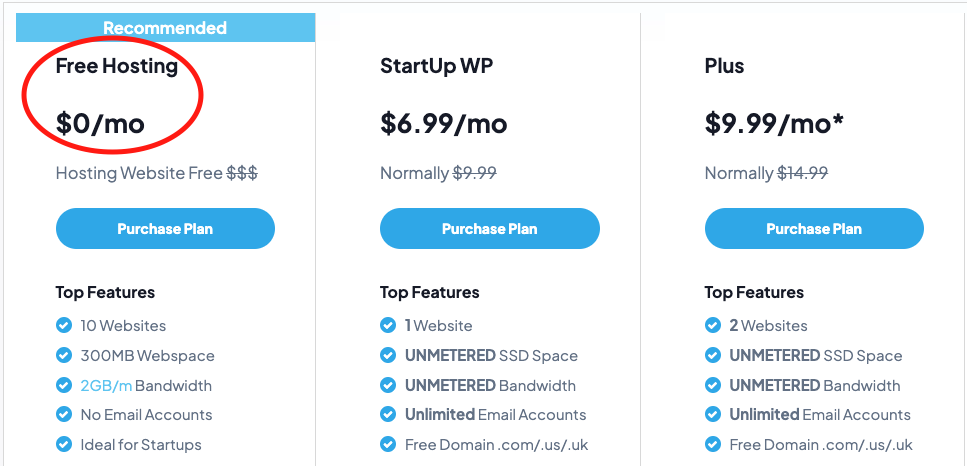

SEO Optimized WebSite for $1/mon?

Get $1 Web Hosting – with 99.99% Uptime

Free SSL

Free Domain

Business Email

History of Reverse Charge

Reverted collection, where the recipient is obliged to pay taxes, is common in many countries such as Canada, where it is applicable to imports of intangible services and properties.

Normally, the supplier gives the transaction tax. In certain cases, the recipient is responsible for paying the tax, that is, the charge is reversed, so it is called reverse charging.

In India, this is a somewhat new concept introduced under GST. The idea of this charge is to increase tax compliance and tax income.

Earlier, the government was not able to obtain the service tax from several disorganized sectors, such as freight transport. Therefore, compliance and tax collection will be increased through the surcharge mechanism.

The reverse charge under service tax (old regime)

The idea of the reverse payment mechanism was already present in the service tax (former regime). In the GST administration, the reverse charge is suitable for both services and goods.

The concept of reverse charging for goods is a new concept (except for the purchase tax on a few goods in a few states).

Some of the services, where the Reverse Charge was there under the Service Tax (old) regime are:

- Insurance agent

- Services of a director to a company.

- Provide labor

- Freight transport agencies

- Non-resident service providers

- Any service that involves aggregators

- What is the reverse Charge in GST?

It is a new idea that is introduced in GST in India, to increase coverage, tax revenues, and agreement of partially or disorganized sectors.

The early products were not under this scheme, now the GST collection will increase greatly. In GST, the provider will be reliable to collect taxes on the goods and services provided. But the central government has the capability to notify the categories of supplies upon which the service recipient has to discharge the tax obligation.

Therefore, all provisions of the Law will now apply to the recipient of such goods or services as if he were the provider of said goods or services.

When an individual becomes responsible for paying taxes on the reverse charge, certain provisions such as threshold exemption, supply time, taking advantage of the entry credit changes.

There is a limit for the turnover that is added to Rs 20 lakh for the registration of normal taxpayers, but under the inverse charge, there is no such limit. The person must be registered under GST regardless of the aggregate limit.

Reverse Charge Applicability

The services provided by an e-commerce operator will generate a reverse charge and must pay GST. If the person evaluated does not have a physical presence in the taxable area, the representative of said e-commerce operator will be required to pay taxes.

If there is no representative, the advisor must designate one who can pay GST. Consider an example of a reverse load under GST. For example, ABC provides services of a plumber, an esthetician, an electrician, etc. therefore, instead of registered service providers, ABC has to pay GST and charge customers.

If the registered distributor is buying goods or services from an unregistered distributor, then the registered distributor will be subject to the payment of taxes on the supply.

But, buy of up to Rs 5,000 per day from unregistered manufactures will not enamor GST. In other words, there is a surcharge on the purchase of unregistered distributors if they are unregistered suppliers and make payments in excess of Rs 5,000. Let’s understand through an example.

Suppose a registered company called ABC Ltd. has spent Rs 8,500 on purchases from an unregistered individual. In this case, should GST pay through the reverse charge mechanism on the total amount or the amount that more than the threshold limit?

Once the limit of Rs 5,000 is crossed in one day, the GST is paid on the total amount of Rs 8,500 through the reverse loading mechanism and not the excess amount of Rs 2,500. All other types of supplies will be suggested by the central or state government that will correspond to the reverse charge.

SEO Optimized WebSite for $1/mon?

Get $1 Web Hosting – with 99.99% Uptime

Free SSL

Free Domain

Business Email