Top 5 Online Payment Methods for E-Commerce Sites

There are a couple of principles that includes that each eCommerce site must need to work together. Maybe the most basic of all is an approach to get paid.

On the off chance that you can’t take online payment, the primary objective of your business—profiting—is unthinkable.

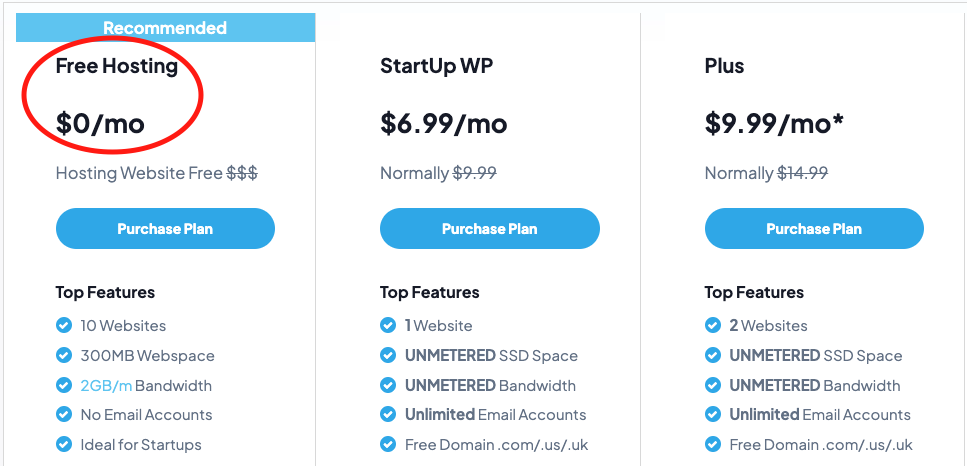

Start a WebSite for $1/mon?

In the aggressive online commercial center, having one approach to acknowledge payment is required. However, having various could put you in a favorable position.

Web-based business organizations have several online payment techniques to consider. Each encouraging to give an instinctive and secure checkout method.

Ensure you’re giving the best payment techniques to your clients (and catching whatever number deals as would be prudent). Here’s the principle data you have to think about online payment strategies and the best choices accessible.

What is the meaning of Online Payment Gateways?

Online payment entryways are the eCommerce administrations that procedure payment data for sites. Online payment portals offer two fundamental advantages to eCommerce organizations:

- They make the checkout procedure quick and simple.

Have you at any point begun to make a buy just to understand that the way toward purchasing took excessively long. And required more work than you were happy to do?

The normal rate of shopping basket relinquishment—individuals who communicated a reasonable goal to purchase and after that didn’t—is around 70%.

On the off chance that your checkout procedure places hindrances in the method for making a buy. The probability that you’ll lose deals due to it is high.

A decent online payment door makes the procedure straightforward and natural. So you catch the vast majority of those deals instead of losing them.

When you set up a WordPress installation at that time, you can buy the best web hosting plan to get the principles of the best payment gateway from web hosting companies.

- They give encryption to keep your client’s data secure.

The danger of wholesale fraud implies that each online exchange a client makes requires trust. You need to ensure that the delicate data they give you is shielded from programmers around the web that look to take charge card data from powerless locales.

Since online payment entryways have some expertise in handling money-related data, they have the best possible encryption and wellbeing highlights to protect your clients’ data.

5 Online Payment Methods for E-Commerce Sites:

All online payment services in the market are secure ways of payment.

So we can securely use all the technology used to make payment online or transfer the money from one account to another account.

- PAYPAL

Paypal is one of the greatest and most natural of all online payment choices. This site has more than 254 million clients.

That is many individuals who might have a less demanding time making a buy on your site if you let them look at Paypal.

The administration flaunts that it’s as of now utilized by more than 17 million organizations. Clients who use PayPal look at believers at 82% higher rates than with other payment choices.

That is a really convincing motivation to utilize PayPal. Fortunately, adding a PayPal catch to your checkout procedure is entirely basic (even though you may need to work with a designer on the off chance that you don’t utilize an eCommerce arrangement).

I hope to pay 30 pennies in addition to 2.9% for each buy handled through PayPal.

- AMAZON PAY

Paypal might be the mainstream; however, Amazon is undisputedly a standout amongst the most prominent destinations over the entire web and one that practically the entirety of your clients will have accounts with as of now.

Adding Amazon Pay to your store can make it less demanding for Amazon clients to shop with you without entering their installment information in your checkout.

You’ll lessen obstructions to buy for many clients while likewise offering an installment choice that the organization guarantees has demonstrated extortion security.

Amazon’s installment technique functions admirably on cell phones, offering a consistent affair where it makes a difference most.

Setting up an Amazon Pay catch your site with their Express Integration choice can take mere minutes. Or then again, you can utilize their API, which takes somewhat more.

However, it enables you to redo the experience to all the more likely fit in with your site. As with PayPal, the expense of utilizing Amazon Pay is 30 pennies in addition to 2.9% for each buy.

- GOOGLE PAY

If anybody can contend with PayPal and Amazon for a piece of the overall industry, it’s Google.

The organization presently offers its very own online payment technique, Google Pay. Google says many millions of their clients as of now have card data spared to their Google accounts, which implies giving a Google Pay alternative offers included comfort for a critical number of individuals.

Similarly, as with alternate choices, they guarantee an instinctive procedure—on the work area and versatile—and first-class security through encryption.

Google Pay likewise gives retailers a chance to set up reliability programs, computerized gift vouchers, and arrangements for clients so everybody can skirt the paper and plastic cards. What’s more, Google Pay works with PayPal and Visa Checkout for included reach.

Remarkably, they don’t charge you anything for utilizing the administration. It’s free for both you and your clients.

- American Express

American Express probably won’t have the piece of the overall industry that our initial three online installment passages do, yet it has something similar as important: shopper trust.

While American Express isn’t as universal as a few of its charge card rivals, it has one of the most noteworthy fulfillment rates in the business. It will, in general, focus on a higher-pay buyer than other Mastercard organizations.

The general population who might locate an American Express checkout choice alluring will probably be a portion of the best guests you’d need to draw in.

They guarantee misrepresentation insurance, daily client bolster, and the adaptability to work with various installment processors and think about various extra highlights.

What’s more, they can acknowledge more than 120 monetary forms, so in case you’re keen on pulling in global clients, which is a major advantage.

As you may expect, the catch is that the alternative costs more than the vast majority of your different decisions.

Costs for American Express’s passage begin at $20 every month for up to 100 exchanges. However, go up for extra exchanges. Also, they have a setup expense over that number, which begins at $99.

- Apple Pay

For individuals who use Apple gadgets, and that is over 64% of individuals in the U.S., Apple Pay fills in as a portable wallet when they’re out on the town and a single tick payment alternative on sites that acknowledge it.

For versatile clients, clients can even look at Apple Pay by utilizing their recognizable touch-proof. It doesn’t get a lot less demanding than that.

Apple Pay utilizes tokenization to keep Visa data secure, implying that once a client gives their Mastercard data to the administration. The gadget speaks with the issuing bank to make an arbitrarily created number (or token) to speak to that card.

That darkens the data from programmers, guarding buyers’ monetary information while working rapidly.

You can set your site up to acknowledge Apple Pay by utilizing its API, as long as you, as of now, utilize one of the perfect stages or installment suppliers.

Like Google, Apple’s installment portal is free for the two vendors and clients.