How to Find a Good Accountant for Taxes

Task description of any staff member aid in getting the attention of the possible and appropriate individuals. The Task description of an accounting professional informs the prospect of their responsibilities and obligations prior to signing up with a business.

It likewise outlines the requirement of work, environment, and expectations by the companies. So, all the accounting professionals ought to check out the complete task description prior to signing up with a business.

If JD is fulfilling your requirements, then you need to use and go even more with confidence. Here are a couple of discussed jobs that business is anticipating from an accounting professional.

- Supplies monetary info: In this job, an accounting professional needs to offer records of accounting and monetary reports. These are kept day-to-day. Nevertheless, there are software applications that are being utilized to tape them. It likewise consists of accounting, recording, categorizing, and examining reports. Accounting information is preserved in various requirements that are set by the accounting authorities. So, an accounting professional must learn about them.

- Comprehending of possessions, capital, and liabilities: Assets are various in accounting, so categorizing them into properties and costs is the duty of an accounting professional. Each of these accounts has a couple of particular entries, and one accounting professional follows the requirements and categorizes them based on the guidelines. This is an art of accounting.

- Evidence-based recording: There ought to be evidence for every transaction in accounting, so one accounting professional must tape them and conserve them for future use of audits. So, the accounting professional ought to understand how to keep them and categorize them according to the guidelines. All the billings need to be conserved physically with the proof.

- Monetary Actions Recommend: All the accounting professionals, in addition to recording and categorizing, have some jobs. The accounting professionals anticipate these in Adelaide. They are anticipated to supply organization choice and forecasting based upon monetary declarations information. So, it must be evaluated throughout the recruitment procedure to work with not an accounting professional; however, likewise, a company consultant.

- Summing up the entire accounting: There are great deals of information, countless billings, a lot of income slips. However, what is the charm of accounting? To enhance the entire information and make a summary report. It is likewise called a balance sheet, and this sum up the overall variety of properties, liabilities, and capital on a single sheet. In this way, one might evaluate the worth, development, and status of business rapidly. So, an account needs to understand how, to sum up, the information. Employers run out time to end up or sum up. Hence, accounts are being employed for this reason.

- Managing the accounting: You can handle the accounts, for this professional accounting needs to keep and enforce the guidelines. All such laws are specified and made by accounting professionals. So, they ought to depend on the mark and positive adequate to make the associated policies. Often, treatments are made to run control efficiently and effectively. By managing, they can supply the preferred info to business along with auditors.

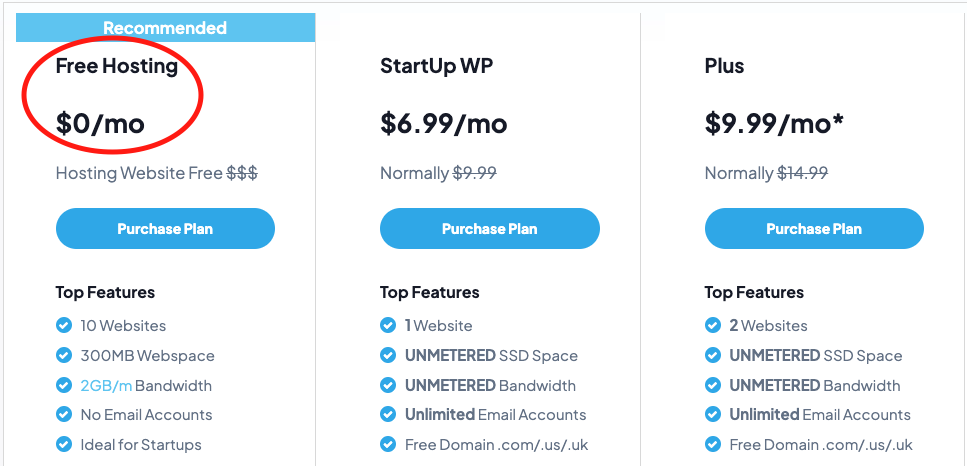

- Cost: Good accounting professionals or cheap tax accountant in Adelaide are operating at small costs. When you are employing a full-time accounting professional, make certain the worth versus the charges if he is capable enough to manage your accounts within your budget plan.

- Prepare wage slips, payroll accounts, and keep the bank: This is another critical job done by the experienced and licensed accounting professionals. They made incomes, manage them, and handle the payroll accounts of brand-new staff members. For this, all the files of account opening, registration of the worker, and other pertinent files are made by the accounting professionals. So, it is part of the accounting professional task description.

- Confidential information caring: A lot of files and information in a company’s trick. And account needs to keep the personal privacy of such information. This protests the disclosure arrangement of the business. So, you are trusting on an accounting professional and must examine the dependability of the account prior to working with it.

This is the comprehensive fundamental task description of the accounting profession. Lots of other jobs rely on the requirements of the business. These could be part of the task description– for instance, tax, insurance coverage, cost accounting, managerial accounting, other jobs.