How to Apply for a Loan without Credit Check – Benefits, Eligibility

Getting a loan could be a good way to deal with a bad financial situation. People with bad credit might benefit the most from loans that don’t check their credit. Loans with no credit check are for people who have bad credit and need help getting a regular loan. Even though these loans have higher interest rates, you may still be able to get the loan you want.

The lender in these types of loans doesn’t care about your credit score. They are also easy to get and can send cash as soon as the next business day. These loans are a great way to get out of a financial jam when your credit score isn’t good enough for a regular loan.

Here, we’ll talk about the benefits of applying for a loan without a credit check and the qualifications you need to meet.

What are the benefits of asking for a loan without a credit check?

One of the advantages is that you won’t need to worry about your credit rating. If your credit is poor, you may still qualify for a loan. This means that even those with imperfect credit histories may be able to secure the financing they require.

It’s possible that filling out a loan application that doesn’t require a credit check might be less time-consuming and more convenient than the conventional one. You may get a loan accepted considerably faster if you don’t have to worry about your credit history. This might help you get cash quickly.

Applying for no credit check loans may save you money. No credit check implies no credit-based interest rates. This might save the borrower a lot over time.

Requirements for this type of loan

Most of the time, lenders want borrowers to have a steady job, a steady income, and a government-issued ID card. Also, borrowers must show proof of their address, like a utility bill or lease, to get the loan. When you apply for a loan that doesn’t need collateral, you may be asked to put up an asset as well. Creditors also usually want borrowers to be at least 18 years old and not have been bankrupt before.

On top of these general requirements, you may also have to meet some loan-specific requirements. For example, If you are looking for a payday loan, you must have a job and a consistent source of income. When applying for a business loan, you must submit a business plan and other necessary documents.

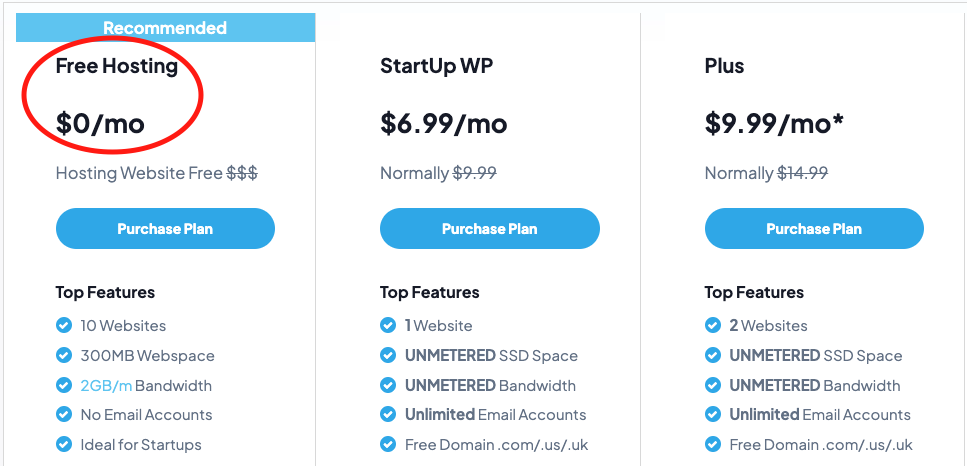

Finding the Right Loan

Finding the appropriate loan without first checking your credit could be challenging. There are a variety of loan choices available to people with less-than-perfect credit.

Payday Loans

One of the most popular ways to borrow money is through a payday loan, a short-term loan that can be used to pay for unexpected costs.

Most payday loans don’t require a credit check, and the borrower pays back the loan when they get their next paycheck. Even though these loans with no credit check may be a good option for people with bad credit, they can be quite expensive, so it is important to know the terms of the loan before signing anything.

Cash Advance Loans

A cash advance loan might be obtained by those who have poor credit. This loan is like a payday loan, but the interest rate is usually higher, and the time it takes to pay it back is usually shorter. This loan is often used to pay for unexpected costs, and there is no credit check. But you should be aware of the high-interest rate and short time to repay the loan.

Personal Loan

You could also get a personal loan. This loan doesn’t require a credit check, and it’s usually used to pay for big expenses like home repairs or medical bills. Personal loans usually have lower interest rates and longer terms for paying them back than payday loans or cash advances.

However, it is essential to do some comparison shopping to discover the greatest deal. It’s also important to look closely at the loan’s repayment terms because they could have a big effect on your credit score.

Advice for Loan Applications

It might be scary to try to get even small loans without a credit check, but you can do it if you do your research and get ready. Many lenders offer loans without checking your credit, so it’s important to do your research and choose the lender who best meets your needs.

Having a firm grasp of your desired loan type and monthly repayment capacity is crucial. Getting a loan that works with your budget and gets you closer to your objectives is crucial. A lender may think more favorably of you if you can prove that you will be able to repay the loan.

Tell the lender the truth, and don’t hide anything. Tell them you want a loan that doesn’t check your credit, and give them as much information as you can. This will let them look at your loan request and give you the best loan option for your situation.

Conclusion

Obtaining a loan without a credit check is a wise decision for many individuals in need of funds. This may be particularly useful for those who are just beginning to establish credit. This also applies to those who are seeking alternatives to conventional lending sources. Additionally, acquiring a loan without a credit check might be a quicker and simpler way to get the money you need.

These loans often have higher interest rates, but they might be a viable option for folks who need cash immediately. By obtaining these loans, one may get the funds without worrying about their credit history.

Before agreeing to a loan, it is essential to investigate available possibilities and ensure that you fully grasp the conditions. Obtaining a loan without a credit check is a wise decision for a large number of individuals in need of funds.

- https://www.londonloansbank.com/loans/

-

london blog - on