10 Horrible TAX Mistakes

Many mistakes are committed by the taxpayers while filing the returns at the eleventh hour. When you make mistakes in the tax returns, it will slow down your application processing time, and it takes a lot of time for you to receive a refund.

Sometimes, you may also have to pay hefty fines for making blunders in tax filing. However, to reduce the errors, you can seek the help of a tax preparer.

This person will file the returns accurately without leaving any room for mistakes. More often, the mistakes happen when the taxpayer is confused.

There are free people recruited by the IRS to offer help on tax queries, especially when you have to deal with pension and retirement issues.

You need to provide accurate information to the tax preparer. Otherwise, your tax information will be inaccurate and full of mistakes.

A few of the horrible mistakes that you encounter while filing the tax returns include:

File the paper returns

When you file the tax returns on a paper, there are high chances of you forgetting to sign on the dotted lines and miss to present the critical information.

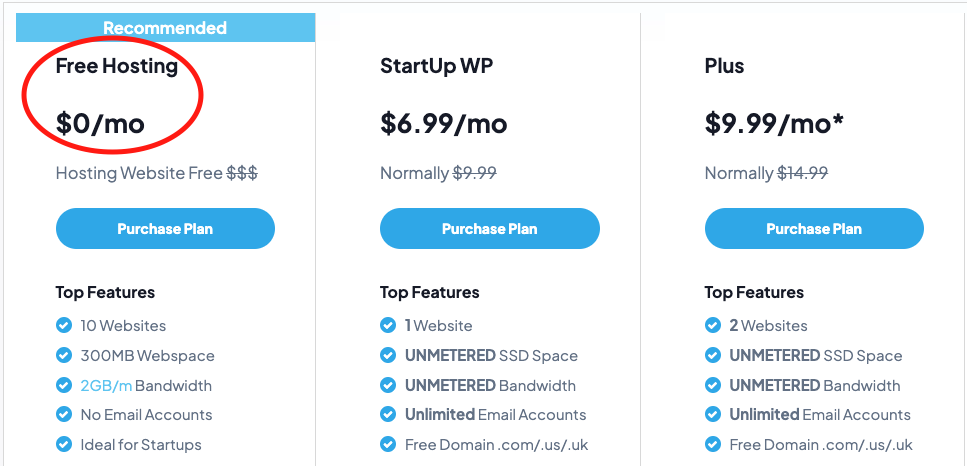

However, you also do not need to spend a considerable amount of money to buy tax software or spend money on hiring a tax preparer.

You can simply go to the government tax website to file the returns immediately. The program on the website will keep the math errors at bay and allow you to add additional forms with ease. This form will not allow you to submit the tax returns without your signature.

Use wrong names or numbers

You can avoid mistakes by double-checking the information before submitting it. This can help you to keep mistakes from becoming worse.

You need to make sure that you have put the social security information of you, your spouse, and dependents on the returns in the same way as it is on the social security cards.

You need to make sure that all the details that are put on the form are correct. This helps you to submit the tax returns to the IRS quickly.

Choose the wrong filing status

Five different types of filing status are available. These include – single, married filing jointly, married filing separately, qualifying widow or head of the household. Based on your status, the tax deduction would be made.

The status will decide the eligibility status for a few of the credits. If there are multiple filings, then it puts you in confusion. For instance, if you got married and lost your spouse last year, you can seek the help of a tax preparer; they will guide in filing the tax correctly.

Do not pay tax on the income earned

If you are reaping the benefits of your social security number or taking a pension or working as a full-time or part-time employee, you will be taxable on social security.

If you are not paying the taxes on time, the IRS will slam penalties and will prosecute you. Though you do not have enough money to pay the taxes, you must still file the tax returns. If you do not file the taxes, you may have to pay more penalties.

File the tax late

You must not wait until the late day to file the taxes. Instead, you should be proactive to prepare all your returns and file it before the deadline. This prevents you from paying an additional fee for submitting the tax returns late. If you file late, you are also slammed with penalties along with interest.

You may have to pay 5 percent every month on your total tax as an interest. When you fail to pay the penalty, you are slammed with 0.5 percent of interest on the total amount you have to pay as a tax every month.

If you do not pay the tax completely, you also need to pay interest to it. If you are yet to get a refund, you will not be slammed with penalties even if you file the returns late, but it is safe to file taxes in advance to the given date.

Being aggressive on the part of the deduction

The key deductions that are cut from the taxpayers include charitable contributions, medical expenses, and mortgage interest. Many people follow their friends and do the same that is done by their friends. However, you cannot get the tax benefit without proper proof.

You need to have receipts and records to avoid the risk of IRS auditing. If IRS detects any illegal or inaccurate receipts, they will slam you with additional tax liabilities.

You need to take the help of professionals when you have any doubts related to the tax to make sure that the deduction is legitimate.

Incorrect bank account numbers

If you file the returns and give the direct deposits, you can easily get the refunds in a couple of weeks. The process is swift and easy.

However, the process is quick and smooth only if you give accurate information. You need to make sure that all the bank information is entered correctly. If you have any doubts, you can cross-check with the bank.

Not signing the forms

In the haste to get returns immediately, you would miss signing the returns, which is the most common mistake that is cited by IRS ever year.

This is a horrible mistake since a tax filing that is unsigned would not be considered as a valid return by the authority.

A return that is submitted on time with accurate information and sign is considered as a valid one. If you and your spouse are submitting the returns, you both must sign on the returns paper to make it accurate.

Risk the passport

The IRS will take the information of the people who are earning more than USD 50000 a year from the state department and check for the arrears they have to pay as taxes. You need to work with the agency to resolve the tax issues. If not, these people will revoke the passport.

Fear to file the returns

There are a few people who learn how much they have to pay to IRS and decide not to file the tax returns since they may not have enough money.

If you fail to pay the tax, you would be penalized. If you cannot pay the tax amount that you are intended to, you must file the return and pay as much as you can. You can use the IRS payment options to pay the remaining amount later.

Author’s Bio:

I’m currently working as a Chartered Accountant with Payroll Agencies UK. I have a great passion for outsourced accounting services. In a previous couple of years, I have worked with big and small clients across numerous continents.

I have a keen interest in outsourcing payroll processing, accounts payable outsourcing, BPO outsourcing, outsource finance, outsourcing accounts, outsource bookkeeping, offshore Back office services, etc.